Understand the Breakeven Point to Right Size Before Its Too Late

SAN DIEGO, CA, UNITED STATES, September 27, 2022 /EINPresswire.com/ — 5X Solutions, LLC, maker of Telemetry BI mortgage business intelligence platform has announced a new tool to help companies manage their overhead and expenses.

Loan originations have dropped by 50% and may not have bottomed out. To survive in the current market, lenders are faced with redefining their business projections and “right-sizing” their business models to fit the demand. Companies that are doing this will remain competitive, mitigate over staffing losses, and set a new baseline from which they can grow their business.

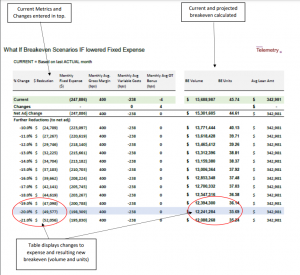

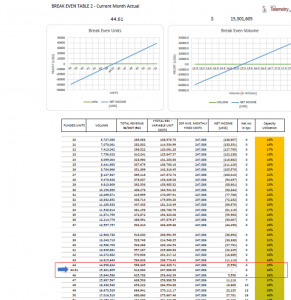

To assist with this task, 5X Solutions has developed a “What If” scenario process providing guidance on how strategic changes will impact lenders’ bottom line. Their tool provides a model to lower the breakeven point to its minimum volume. Then, it provides insight into the potential profit as lenders originate units and volume above that new norm. Results are monitored based on lender actions providing monthly analysis of the resulting outcome until the final changes have been realized.

The purpose of this is to help make quick, impactful decisions with the following perspectives factored into the simulation:

1. Gross Margin – increase (decrease) for competitive reasons

2. MLO Comp – decrease for margin preservation; or increase for MLO retention

3. Cost Reductions – fulfillment FTEs; recurring third-party services

4. Bonus plans – are these aligned with the desired strategy?

5. Net Margin, Breakeven, and Potential Profit (post adjustment)

Using closed loan counts, financial data, and a list of changes (e.g. margins, bonus plans, fixed expenses, recurring vendor services, etc.) the tool provides a report that shows “what if” scenarios including a matrix of cost-cutting to help guide decisions. Then 5X Solutions will follow up for three months until the cost-cutting measures have been realized to their fullest extent.

Ronald deFrates

5X Solutions

email us here

Mortgage Business Intelligence: Know Your Numbers, Know Your Business

![]()