While the industry moves to all-electric vehicles, new vehicle shoppers are more likely to purchase a traditional hybrid than a full battery-electric vehicle.

— Robby DeGraff, AutoPacific Industry Analyst

LONG BEACH, CA, USA, October 20, 2022 /EINPresswire.com/ — While motivation accelerates for an all-electric future from both inside and outside the automotive industry, new vehicle shoppers are more likely to purchase a traditional hybrid than a full battery-electric vehicle within the next three years, according to AutoPacific’s 2022 Future Attribute Demand Study (FADS), which gauges consumer interest in more than 120 vehicle features and powertrain types. Automakers are quickly adding a flurry of EVs to their lineups to meet sweeping mandates and zero-emission goals, as well as growing demand, but range anxiety, lack of at-home or public charging infrastructure, and purchase cost remain a concern for many consumers.

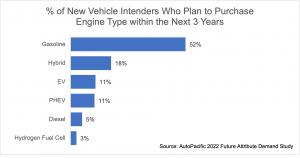

Expectedly, demand for gasoline engines is the strongest at 52% of all new vehicle intenders in this year’s study, which also means that nearly half of all intenders plan to acquire something other than a gasoline powertrain. For electrified powertrains, demand is the strongest for traditional hybrid powertrains at 18%, while plug-in hybrid and EV powertrains each earn 11% intention among of all new vehicle intenders. Demand for diesel is scant at 5% while hydrogen fuel cell powertrains register just 3% demand.

AutoPacific’s analysis suggests that the ease of purchasing and owning a traditional hybrid vehicle versus a more advanced EV is likely the primary reason behind their higher demand. Traditional hybrids eliminate many of the perceived “headaches” of owning an EV. There’s no added need for a consumer to invest in an at-home charging station, plan their driving route based on available public charging stations, or fear range anxiety. Furthermore, many of today’s hybrids promise combined average fuel economy approaching 60 mpg, while many hybrid mid-size SUVs can approach 40 mpg. “Not everyone may be set up to own an EV yet and for many new shoppers, traditional hybrids are still the most accessible and affordable way to go green,” says AutoPacific Industry Analyst Robby DeGraff. “Hybrids have impressively evolved over the decades. They’re now found powering a much more diverse mix of popular bodystyles including pickup trucks, SUVs, and crossovers.”

Price Plays a Large Role in Hybrid vs EV Demand

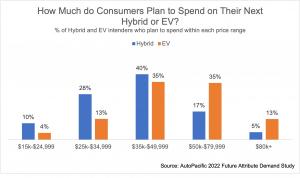

Sticker shock is another roadblock for EV intenders, but not for affluent consumers who may be better prepped to pivot away from ICE ownership. Data from this year’s FADS study reveal that among intenders of EVs, 48% plan to spend at least $50k on a new vehicle, compared to just 22% of traditional hybrid intenders. “The truth is, there are actually quite a few great lower-priced EVs below $50,000 on sale right now, and on the way soon from multiple automakers,” DeGraff said. “But many consumers may not be aware of them just yet.”

Shoppers not wishing to open their wallets wide in order to lower their carbon footprint can find reprieve via efficient traditional hybrids that are readily available at more approachable price points. As such, there’s more desirability for them and less financial burden. Data show that among intenders of traditional hybrids, 78% plan to spend below $50k on a new vehicle, compared to just 52% of EV intenders.

While demand for EVs is on the rise and more affordably priced models are entering the scene, there are many longstanding issues that need to be addressed over time in order for demand to outpace that of ICE and traditional hybrids. Until then, hybrid vehicles will continue to serve as the key pathway for consumers to collectively move towards a zero-emissions future.

About AutoPacific

AutoPacific is a future-oriented automotive marketing research and product-consulting firm providing clients with industry intelligence and sales forecasting. The firm, founded in 1986, also conducts extensive proprietary research and consulting for auto manufacturers, distributors, marketers, and suppliers worldwide. The company is headquartered in Long Beach, California with affiliate offices in Michigan, Wisconsin, and North Carolina. Additional information can be found at http://www.autopacific.com.

Ed Kim

AutoPacific, Inc.

+1 248-219-0234

email us here

![]()